These are the things that I do for saving money. 5 tips on how to save up for my trips.

1. Large fixed cost

Rent / mortgage is the number 1 enemy. Basically, I try to spend 1/6 or maximum 1/3 of my income on rent. It may sound ridiculous, but that is seriously what I do. It lifts the stress related to low monthly disposable income and helps a ton with saving money.

2. Frequently re-occuring costs

Food is another saving enemy. This is one of those expense that no one can avoid.

Pretty simple maths. If you buy lunch everyday during the week, your weekly cost will be:

EUR 10 x 5 days = EUR 50

5 days x 4 weeks = EUR 200

12 months in a year = EUR 2400

Sheer horror of the consequences of ‘grabbing a quick bite’ or that ‘coffee’.

Fruits, vegetables, meats etc frankly are raw materials. Unless you can taste the difference when you’re blindfolded, which ever place you buy it from is pretty much the same. To me, the key taste difference is in your cooking / preparations.

For raw food, buy from the cheapest

The savings add up quickly. Try it out 😉 Buy your grocery in Monoprix for a week and then buy grocery from only Leader Price for a week. For me, the purchase will be same genre items, but it made a 20-30% difference.

**For UK, I stick to Tesco and the large stores only + I sign up for the Tesco card for extra saving on train tickets.

Also, try out the supermarket’s own branded good. Many private labels are super competitive (in price, taste and quality)! It is worth trying it out. Saving a buck here and there adds up quickly too.

I am quite the miser when it comes to grocery. I spend maximum EUR250 per month (for 2 people). This is only achievable by only purchasing from Leader Price, Frere Tang or buy from other supermarkets when they run specials.

Personally, I am not a fan of organic anything. I honestly cannot taste the difference, so why pay for it? In fact, I am almost anti-organic and actively not purchase any products certified ‘organic’.

Plus, I generally do not buy any processed food. E.g. pre-diced, pre-marinated etc. That also saves me money.

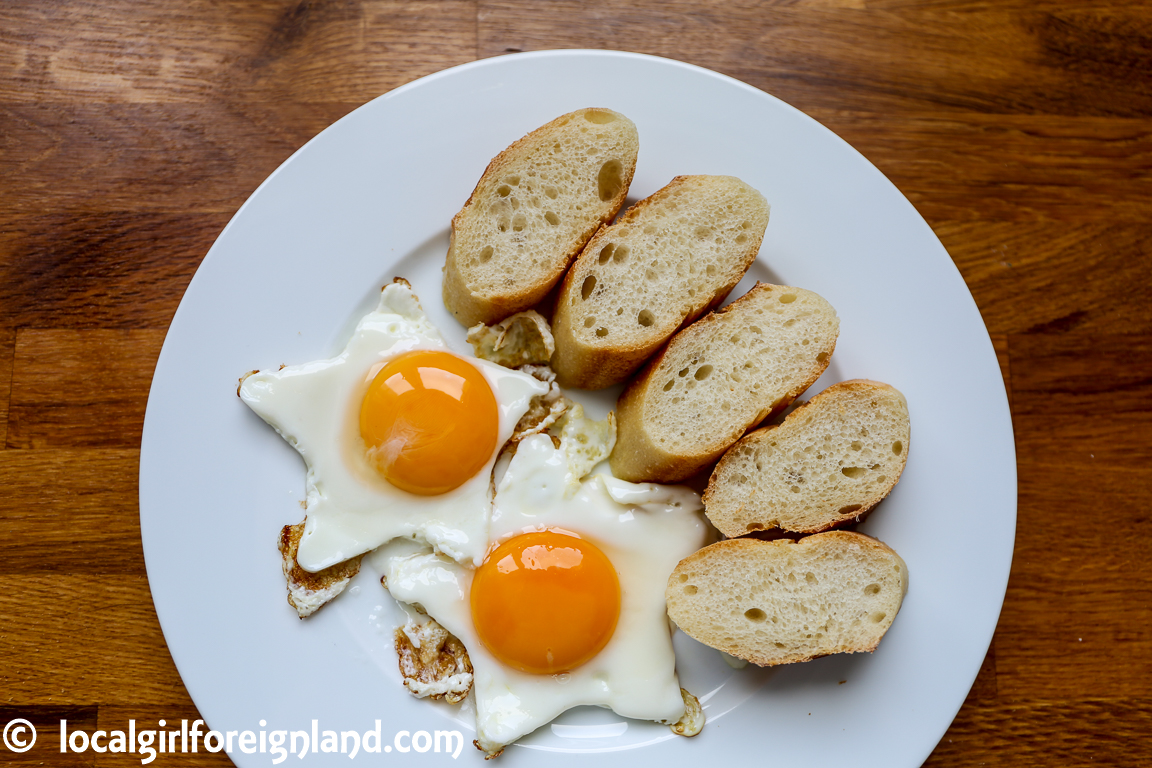

Okay now, the question will be… is my cooking any good or will the food look depressing. Here are photos of my home cooking.

All it takes is a little creativity and attention to details (mainly, plating). It takes seconds to make your home cooking to look fab 😉

3. Fixed saving

ASAP I receive my salary, 1/3 is dumped into fix deposit or a saving account. Well, this is mainly for saving up to buy a property, but you get the idea. Leave this money ALONE. Unless there’s real emergency e.g. hospital etc, do NOT touch this saving.

4. Earn interest / Investment

Either place the money that earns interest or if you can handle the risks (e.g. losing money), you can consider placing the money into investment. ***Please understand that stock market and bond market do have risks. There’s no such thing as free lunch. Financial management firms also charge a percentage as their service fees. READ all the fine prints before deciding to do this.

5. Stick to your monthly budget plan

Sometimes it means skipping out on social activities. Sounds mean, frankly, why spend money or time on people that you’re luke warm towards? Both time and money are limited resource 😉

I use budget apps AndroMoney to keep track of my progress.

Run out of budget = You’ve depleted your ‘forecast’. There’s still money in the bank.

Run out of money = You’ve depleted your ‘forecast’. There’s no money in the bank.

important note

ALWAYS opt to pay your credit card balance in full. The interest is PAINFUL! Affordable credit / advance is SUPER expensive. Think THRICE before taking on any credit. E.g. car is a depreciating asset ==> paying more for something that will worth less.

By applying the above methods, within 1-3 months, I have a sizable saving enough for a trip.

So how about you? What do you do to save money?

Please be a sweetheart & support one of my social media xox

Bloglovin’ / Google+ / Twitter / Instagram / Facebook / Pinterest

Camera: Canon 5D mark 3, Sony Z3+

21 Comments

Great tips Joyce, especially about saving on grocery shopping – something I fail to be mindful about!!

It was very difficult for me too. After I started recording my expenses on APP, it helped me a lot. But after I got my first pot of travel money quite quickly, I became a faithful 😉

I searched out all the hotels with self catering accommodation we wanted and the prices , the best hire car price and an Air New Zealand special deal then gave it all to a local travel agent and got the best price package without any worry. Sometimes travel agents are the easiest way to go at a great price if they use the right wholesaler and they don’t have to waste time searching. But you are young and fit so I would suggest do the North Island in a camper van then do the South island in another camper van, but make it 2 different visits. There are camping sites everywhere you pull in, park, hook up to power and cheap and fresh produce etc is easy to find and its fairly safe. All you need is a plane ticket, camper van deal paid for and insurance. Also you get off the plane and through customs etc in NZ in under 30 minutes. You may just need a hotel the night you arrive and the night before you leave

Thank you, Denis!!! That’s fabulous (and comprehensive tips). I will start to read a bit more about the Maori and NZ history before planning a trip 😀

I think you have seen all my New Zealand posts since December 2016?

???? yes, I have read them all ???????? that’s why I want to go haha

Some great tips Joyce, so much can be saved eating your own prepared food and doing free activities. We travelled New Zealand in 2016 and self catered all our meals and did heaps of free things.

That’s amazing! I really want to do New Zealand soon. Accommodation planning has been a real challenge. What did you use for booking your accomodation?

Some healthy money saving tips

Thank you, Sangeeta ????

Great tips, saving can be hard, but for traveling its worth it…

Yes, it’s all about choice and discipline ????

Indeed, anyway I’m Max, nice to meet u..

http://www.poshpackerteam.wordpress.com

Nice meeting you, Max ????

Good advice!

I try my best to stick to a monthy budget but I’m an impulse shopper. And an impulse snacker while I shop. Ugh .I’ve been getting better lately though. Small steps 🙂

Impulse snacking is so hard to kick~~ I agree, small steps and stay strong 😉

Nope, your rule of thumb for housing costs is spot on. One of the reason why most people are “house poor”… they spend way too much on housing.

Eh, for me the cost of lunch isn’t terrible – we don’t do extravagant meals or eat out at fancy places so the daily “fix” is worth it to me. I hate leftovers and cold sandwiches! 😛

This post isn’t just about saving for vacation as it is about personal budgeting! Lots of people just don’t think it takes effort to manage money.

I firmly believe there should be courses in public school on personal financial management. The whole notion of carrying credit card balances is so foreign to me – it was drilled in my head, don’t spend what you don’t have. My SO manages people’s money for a living so I’m lucky to have this in-house! 😉

Thanks, I was kind of bracing myself for ‘miser’ comments ????

I am the budget person in the house ???? I use pie charts combo excel ????you are so lucky to have an in-house manager ????

Personal budgeting sounds so professional. I like it ???? you always come up with such fab titles.

Well, we ARE Cancers so we’re just naturally gifted with money! 😆 😉

For me, it’s about having security / peach of mind. I never ever want to feel like I’m at the mercy of an unplanned event.

Excellent and real tips Joyce. I agree about organic food. No difference to me.

Thanks, Sue ???? haha good to know that I am not alone ????